Why and When You Should Turn to Fintech Software Outsourcing

The finance and banking industry has a long history. But the tech progress in aggregate with evolving client demands and expectancies that we will take a look at at the present time brightly demonstrates the need for amendment. Traditional methods and strategies had been efficient for decades. However, they can hardly ever take care of the tasks that banks and monetary institutions must take care of today. And here is when fintech initiatives must input the sport. These projects leverage the ability of new generation to compete with conventional approaches in handing over monetary providers to buyers.

With the enlargement of this area and its developing position within the market, the demand for fintech software development services is shifting greater. A lot of businesses that experience standards for fintech items do not have in-condominium resources for transforming their standards into real strategies. But because of the flexibility of state-of-the-art business versions, it doesn’t mean that they do not have a probability to continue with the introduction of their apps. In this kind of case they regularly can turn to fintech improvement outsourcing and have their resolution equipped by way of an exterior workforce of experts.

In this newsletter, we're going to give an explanation for what blessings and new opportunities you can enjoy in case you prefer fintech software outsourcing, what versions of constructing cooperation with project teams exist, and the way you can minimize undertaking costs because of working with fintech offshore developers.

Fintech industry: Quick assessment

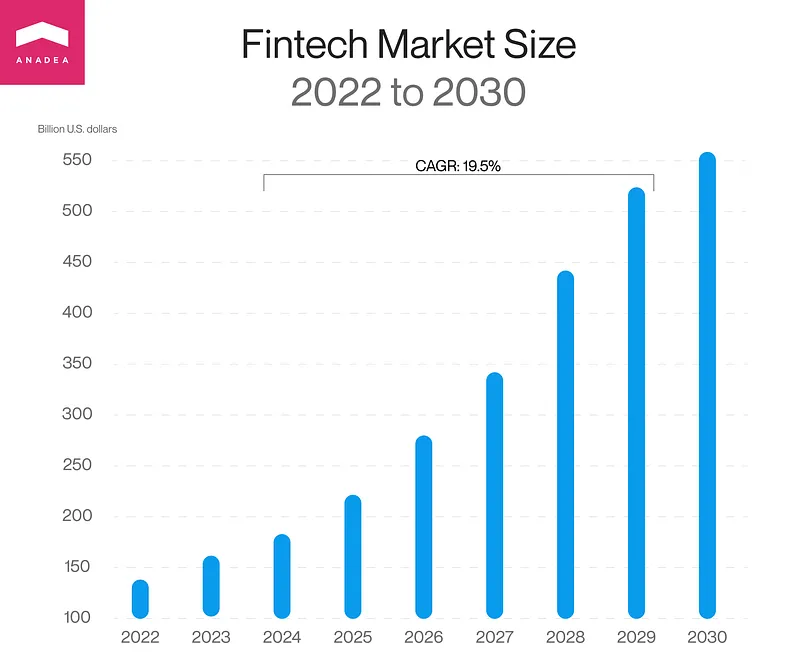

Before we proceed to the discussion the fintech outsourcing as a concept, we offer you to have a study the latest facts. The world fintech market measurement was worth $113. eighty four billion in 2022. According to specialists, this parent can be able to hit the mark of over $556. 5 billion in 2030. It potential that the CAGR over the analyzed length can be 19. 5%.

Of route, on the contemporary second, we will’t say that fintech organisations can completely update banking and financial establishments in the near destiny. However, the role and importance of fintechs shouldn’t be underrated.

Fintech businesses are shaping the direction for the similarly evolution of the finance industry via making monetary prone more value-effective, compliant, and handy to purchasers.

As of June 2023, there were 335 fintech unicorns while at the start of the yr, this list included 329 companies. Their total market value is round $1. 549 trillion. Among the so much distinguished fintech businesses, we should callShopify, Ant Technology, PayPal, Adyen, Stripe, Block, Revolut, and others.

The industry is growing which could be a reputable sign for individuals who are considering an option of getting into the market with new fintech solutions. In considered one of our preceding blog posts, we shared our experience in building fintech mobilephone apps. That’s why if you're making plans to create such a product, our article may be of brilliant use to you.

However, construction a extremely good fintech answer can be not as honest as it may appear and is often related to a row of demanding situations that you just ought to be acutely aware of, like:

To tackle these problems in a proper manner, you will want to have a crew of professional developers by your aspect. Nevertheless, not each and every fintech startup is prepared to create and further hold an in-condo development team. That’s one of the most important factors that raise the recognition of fintech improvement outsourcing.

The upward thrust of fintech outsourcing

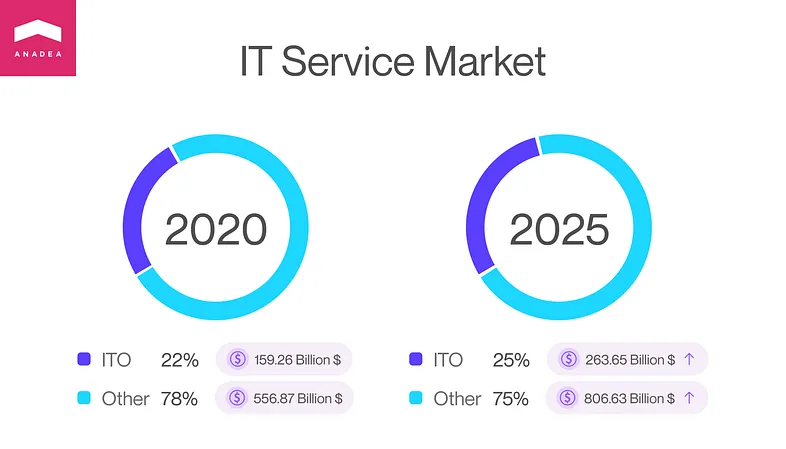

IT outsourcing(ITO) is the largest section of the IT carrier market and it really is anticipated to exceed $430 billion in 2023. In 2027, it'll succeed in a dimension of over $587 billion. The expansion of the ITO segment will happen at a CAGR of 6. sixty eight%. Moreover, it truly is predicted that the percentage of IT outsourcing in the overall IT market could be regularly developing as well.

As it really is somewhat natural, fintech improvement outsourcing also is incorporated in the IT outsourcing segment and, therefore, follows all the fashionable tendencies. Researchers revealed that outsourcing money owed for nearly 18% of the full spending in the fintech sector. Fintech organizations outsource quite a lot of providers like again office initiatives, customer support, details analytics, and others yet product development and tech support prone are among the most general ones.

What businesses always turn to fintech outsourcing?

Startups . It is a well known reality that among those businesses that outsource software development services, there are a variety of younger businesses and startups. Small establishments which are simply starting their company journey frequently can’t actively enlarge their in-condo staff and outsourcing can be a great way out for them. This version facilitates them to cut back improvement charges and reduce negative aspects of failure.Mid-size companies. Thanks to fintech software program outsourcing, mid-size establishments can concentrate extra on their middle business purposes and ambitions. As a outcome, outsourcing will be considered as one of several ways to boom whole business productiveness and ensure the appropriate caliber of software ideas that may be equipped by experts. - Enterprises. Very frequently enterprise-point businesses work with outsourcing companions if you want to optimize development expenses and to allow their inside groups to consciousness on core projects.

Benefits of fintech development outsourcing

Sometimes when our purchasers come to us, they're not certain no matter if it will likely be a possible option for them to work with an external improvement team or it may be greater to rent in-apartment developers. Based on our trip, we can define a row of blessings that you'll be able to enjoy in the event you choose to outsource fintech development as opposed to building software in-apartment.

- Cost-effectivity. The probability to significantly decrease development bills stays one of many pinnacle motives for companies to outsource such services. Thanks to fintech outsourcing, you'll lower your undertaking finances by 2–four instances in comparison to the cases when you decide to rely on your internal resources in building software. The charges of developers substantially vary in varied areas of the realm and such international locations because the US and Canada are between those that have the top rates. That’s why many businesses from this sector, prefer to work with fintech offshore developers. For instance, at Anadea we've an average hourly price of around 50$, while for operating with onshore teams in some countries expenses can be 1.5–2 times higher.Also undergo in intellect that whilst you work with exterior developers, you'll be able to steer clear of lots of expenditures regarding office appoint, equipment, taxes, bonuses, and so on.

- Access to niche experts.When you are seeking out in-condominium specialists, the region of seek is quite restricted. In the majority of cases, you'll be able to seek developers simply in your metropolis. As a result, it should happen that your local hard work market received’t find a way to meet your demand. But when you turn to fintech software outsourcing, you can work with development teams from all around the world and cooperate with experts with the rarest abilities and really good information. However, to leverage this possibility, it will be significant to find a company with a wealthy talent pool.

- Productivity and speed of development.There are several factors that support outsourcing firms accelerate the development method and show appropriate ultimate outcomes. First of all, a good software development manufacturer should have its own approaches and tactics to aid smartly-prepared work procedures. Secondly, when experts with relevant knowledge are working on a venture, they want much less time to meet tasks as they exactly comprehend what and how ought to be executed.

- Risk mitigation. A professional development team assist you to bigger deal with hazards along with safety breaches, hacks, and facts leaks. If your in-house developers have by no means built fintech solutions before, it shall be relatively difficult for them to find the appropriate mind-set to guard your software and users’ information. With fintech specialists, you're at the secure aspect.

- Improved caliber.Outsourcing permits you to work with specialized fintech development teams that have wealthy experience during this industry and a deep understanding of the entire ongoing market trends and needs. Thanks to this, such teams can supply brilliant products that won't only completely correspond to your requirements yet will even bring real price to finish-users. Moreover, when you figure with pro mavens you'll expect to get useful hints on the way to make your non-public monetary app or another fintech solution even better than you have firstly planned.

Types of fintech outsourcing models

If you are considering fintech development outsourcing, sooner than you make a decision, you have to find out what options you have. There are a number of models of outsourcing which are described based on assorted parameters. In this section, we’ve collected the primary news for you that could support you to make up your mind.

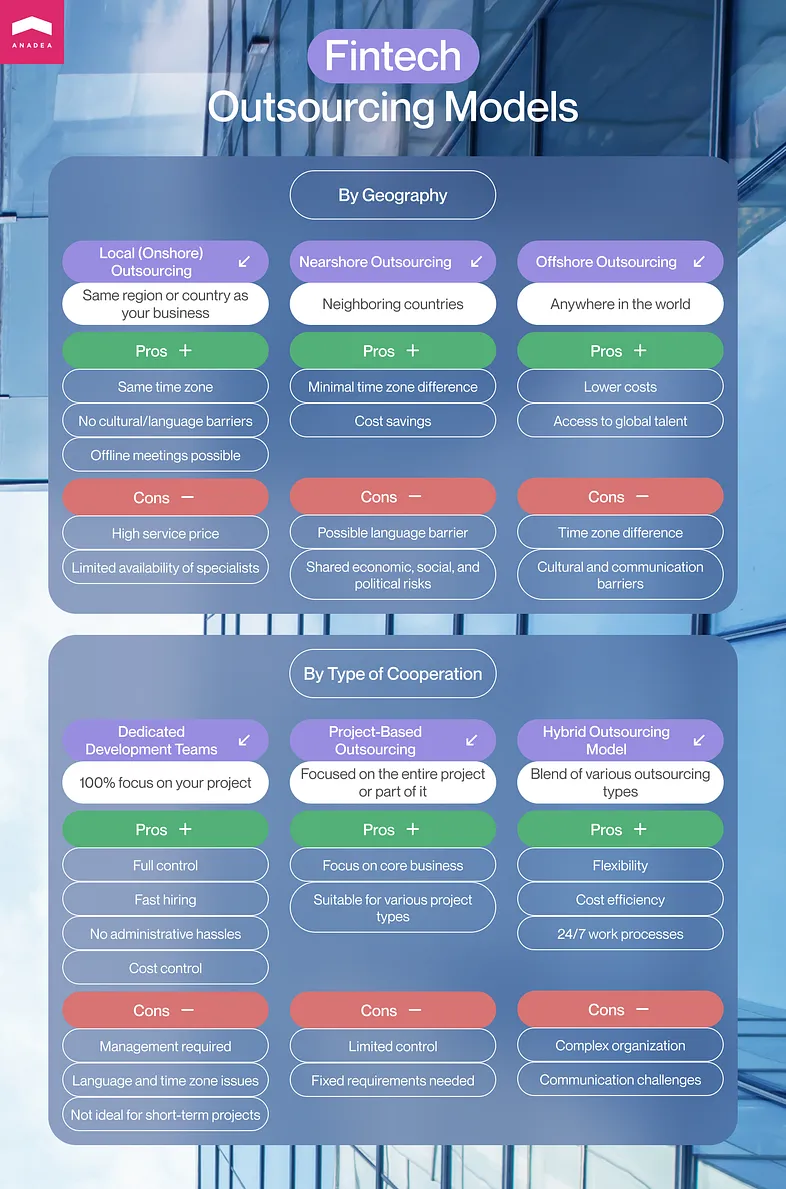

Depending on the zone where you're going to outsource development services, there are the following alternatives:neighborhood(onshore),nearshore, andoffshoreoutsourcing.

Local outsourcingpresupposes that you're going to work with the improvement team that will be based in the area (or country) where what you are promoting is located.

Pros of onshore outsourcing:

- The similar (or very close) time zone;

- No cultural or language boundaries;

- The chance to arrange offline meetings if required.

Cons of onshore outsourcing:

- Service fee (if we are speaking about such countries as Canada or the US, the rates of developers in this region are very high);

- Limitations related to the supply of specialists with the mandatory abilities.

Nearshore outsourcingof development services consists of establishing cooperation with an organization that is positioned in one of the neighboring countries. This model is taken into consideration to be something like a transitional format among hiring neighborhood and offshore teams. It unites some of the strengths of the opposite two models: similar cultures and the risk of reducing development expenses.

Advantages of nearshore outsourcing:

- Insignificant time zone distinction;

- The possibility to save money by slicing project charges (but, on the subject of offshore outsourcing your financial savings will probably be much more severe).

Disadvantages of nearshore outsourcing;

- Possible language barrier;

- Geographical proximity (you will ask us why this is a disadvantage. But geographical proximity in outsourcing always suggests that your development team can also face the similar financial, social, and political risks that you just have in your property nation).

The idea of fintechoffshore outsourcingis based on the concept of hiring a development team which can are living in any country of the world, including other continents and the most far flung regions. For instance, if a US-based company works with developers from Spain or Poland, as an example, it's going to be offshore outsourcing.

Benefits of offshore outsourcing:

- Lower development expenses with out product quality deterioration;

- Access to a world ability pool and the possibility to discover specialists with niche abilities.

Drawbacks of offshore outsourcing:

- Significant time zone distinction;

- Possible cultural barriers;

- Possible difficulties in verbal exchange.

There is also a fairly general opinion that offshore outsourcing is a quite unstable concept as it may be basically impossible to execute control over the improvement method, you won’t meet programmers face-to-face, and they may feel pretty much no responsibility for what they're doing.

But let’s be trustworthy, the same attitude will be also found, even in case you rent developers from your metropolis. Everything relies in your outsourcing associate and there may be no distinction where this company is headquartered.

As for other negative aspects of this version like time zone gaps or language barriers, the whole thing can be discussed beforehand. You can suggest a command of English some of the key requisites for a development team and ask for flexibility in the working hours of programmers and other team individuals.

Type of cooperation

There are two most well-liked models:committed development teamsandproject-centered cooperation.

When you prefer thededicated teammodel, you're going to rent specialists who might be one hundred% centered on your project, will work full-time, and could be controlled and managed by you. But together they will be officially employed by your outsourcing partner and all of the administrative tasks won’t be your responsibility. Based on the concepts of this version, you can rent a whole development team or several experts who will be a part of your in-house developers.

Advantages of the dedicated team version:

- Full keep an eye on over the development system;

- Fast hiring (in comparison to in-house hiring);

- No headhunting, recruiting, and other administrative complications;

- Cost control and team composition flexibility (you'll without difficulty modification the composition of the team at any moment when it really is required);

- Good option for long-time period projects.

Disadvantages of the dedicated team model:

- The necessity to cope with the entire processes on your own;

- Possible language and time zone issues;

- Inefficiency for brief-term projects.

Project-headquartered outsourcingincludes delegating the whole project (or its part) to an exterior team. If you select this version, you, as a client, will should grant precise requirements to a development team and then, they will be fully liable for building your solution (or some part of its functionality).

Benefits of project-headquartered outsourcing:

- The risk to concentrate on core company occasions alternatively of controlling the development method;

- The possibility to make use of this model for projects of different kinds.

Drawbacks of project-founded outsourcing:

- Limited keep watch over over the project awareness;

- Increased project expenses in the event you also use extra services like business evaluation, QA, and project administration;

- The necessity to provide all the necessities at the very starting.

Both ways have their strong and weak sides. It capacity that you'll be wanting to take into account every of them in the context of your possess circumstance. Are you prepared to completely depend on an external team or do you need to manage the processes? Will you be able to provide detailed requirements or do you want to have some flexibility? These are just more than one feasible questions that you would need to reply to decide. If you've got you have got any doubts regarding the model of cooperation, at Anadea, we can regularly aid you to define the most effective choice.

This idea is predicated on the principle of mixing a number of outsourcing types and schemes with a view of achieving the best consequences, adding the most desirable of ultimate products, the most effective collaboration, and essentially the most top of the line bills.

There are numerous types of the model. Among probably the most commonplace alternatives, we can bear in mind the circumstances when businesses integrate onshore fintech outsourcing and in-house development. In this example, the outsourcing team that you rent can work closely along with your in-house workers to speed up the development.

Another case that can demonstrate some great benefits of the hybrid model is outsourcing services onshore and offshore. Thanks to this, you can not simply work with specialists with varied backgrounds but in addition arrange 24/7 work processes. However, it is best to realize that it may be a completely difficult option.

Pros of hybrid outsourcing:

- Flexibility and team scalability;

- Cost effectivity;

- Work with specialists from varied regions;

- Unique business processes.

Cons of hybrid outsourcing:

- Difficulties in the corporation of work of the entire teams;

- Communication between different teams;

- Different methods utilized by teams that should be smartly-combined together.

What fintech services can be outsourced?

When businesses start viewing fintech software outsourcing as a feasible alternative for them, they continually have to discover out what services can be performed by external teams. Actually, we won’t exaggerate if we are saying that at the present time almost all the purposes which are conducted by in-house teams will likely be performed by outsourcing corporations.

Below you will find the preferred fintech outsourcing services.

- Development services.You can either hire a full-stack team or depend on external developers only for building a again-finish or front-finish a part of your solution.

- QA services.They will likely be outsourced at the same time with development services or one after the other. It means that you'll build an answer in-house yet hire an outsourcing manufacturer that may check your software and make sure that it is compliant with all the related rules and legislation.

- Customer aid.When you launch a fintech app, it's necessary to reflect onconsideration on customer service services. If you shouldn't have in-house specialists for appearing these tasks, you'll discover a vendor that offers such services. You can arrange client support through a web chat or a name center. As a supportive instrument, you can also introduce an AI-powered chatbot.

- Data analytics.For fintech enterprises, it is essential to efficiently work with substantial volumes of genuine-time facts. However, facts series, processing, and interpretation shall be very time-ingesting and tough tasks, highly when you have a small team. That’s why quite a few fintech startups favor to outsource such services.

How to desire the best outsourcing accomplice?

As we now have already noted, in terms of any sort of outsourcing, and fintech outsourcing isn't always an exception, it is imperative to make your mind up the proper brand that will give you such services. Unfortunately, at the present time there are quite a bit of unfair market players who can’t do what they have got promised. That’s why you must be very attentive for you to steer clear of disagreeable instances which can result in financial losses, overlooked cut-off dates, and unfulfilled plans.

But even if you are positive that you’ve discovered an trustworthy and accountable team, it is necessary to analyze no matter if it has all the mandatory skills, data, and assets for building your solution. It suggests that it is also required to check the exact regions and business domain names where the company has experience. You can also continuously ask an organization to percentage its portfolio with you. It will be cool if the team has already built similar solutions. If you wish to have to understand what fintech projects we now have worked on, please comply with this hyperlink to get some information about the solutions that we’ve correctly advanced.

What are other factors that you must pay attention to?

- Reviews. Before developing cooperation with a fintech outsourcing partner, read the reviews written by americans who've earlier worked with this brand. We recommend you test such business systems with scores and comments as Clutch and GoodFirms.

- Cultural healthy.Though we are dwelling in the technology of globalization, some cultural variations nevertheless exist which will grow to be a barrier to efficient collaboration. People in several cultures have various attitudes to responsibility, openness in communication, and closing dates. That’s why many businesses favor to work with organisations from same cultures. However, even on the way to hire fintech offshore experts, you will find teams with identical values. To stay away from cultural problems, establishments from North America desire to work with European teams. Moreover, more often than not, software developers in Europe have an splendid command of English.

- Communication channels.Such questions as a way and technique of communication ought to be discussed with your development partner in advance. It is major to make sure that the selected communication gear might be convenient for all parties. Moreover, the selected device needs to assure that you and your partner will be able to quickly get information and react to it. As a rule, this day in the software development industry, companies use quite a lot of messaging and video call apps like Slack, Skype, Zoom, and others.

- Test tasks or trial periods. It is fundamental to have the appropriate americans doing the right things. In the case of fintech software outsourcing, ahead of investing the total amount in the development, you need to test no matter if the chosen team will deal with your project. That’s why quite a lot of outsourcing organisations present trial classes or comply with fulfill check tasks so we can make buyers really feel comfortable. If you aren't happy with the results, it’s larger to seek yet another partner.

Fintech development outsourcing: How lots does it cost?

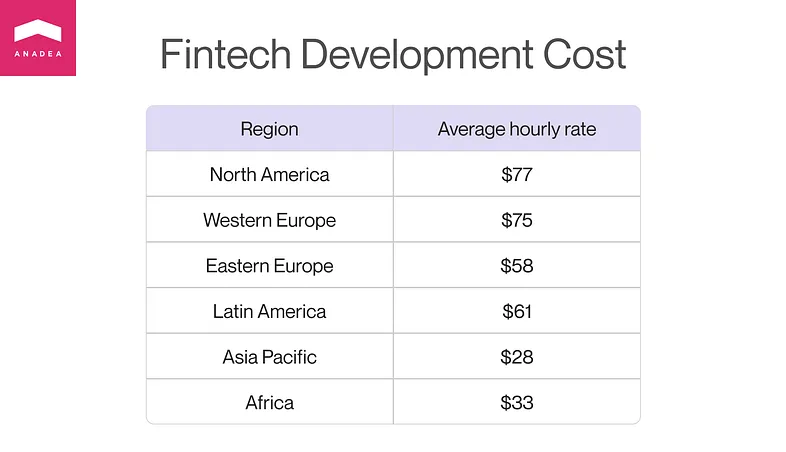

There is yet another major component that our customers continuously ask us about. It is pricing. Well, it depends. There are various parameters that may have an affect on pricing (just like the complexity of your project, the tech stack, the rates of developers, and so forth. ). One of these parameters that will have the most powerful effect is the region of hiring. As we’ve already discussed in our article in the area about onshore, nearshore, and offshore outsourcing, for US-centered companies, it is normally quite feasible to work with fintech offshore developers. The details beneath can brightly prove this concept.

Though in this table we’ve indicated the average facts as of 2023, before establishing cooperation with a specific development team, please constantly check the accepted rates in the past. It will aid to stay away from a variety of unpredictable situations which could result in critical monetary complications sooner or later.

What else must you be aware of when it comes to expenditures and project budgets? That’s hidden expenses, or in other phrases, any unforeseen expenses related with getting some services. Unfortunately, some organizations offer very lovely costs by introducing rates without taking into account taxes that they will should pay, gear that they want to aid, workplaces that they rent for his or her employees, and so forth. As a end result, when their patrons get payments, they're absolutely taken aback to see quantities that are higher than these discussed in the beginning.

Is it feasible to stay away from such unpleasant surprises? Yes, two important steps the following are to desire a truthful vendor and to read attentively all the information supplied in the agreement.

One more finance-related point that we’d like to pay attention to is the pricing model that you'll desire. Hourly rates and glued fee are the 2 most widely applied options. Hourly rates presuppose procuring the authentic time that the team has spent working on your project. In the case of the constant cost model, together with a vendor, it is important to approve the final price in advance situated on project requirements and initial estimates of time and assets which will be needed.

Let’s briefly summarize their pros and cons.

Pros

- Great flexibility

- The risk to introduce modifications

- The possibility to achieve the maximum level of quality

- Approved project price range

- Clear time frames

- Agreed scope of work

Cons

- Difficulties in making particular estimates

- No strict cut-off dates

- Risks of budget overuse

- No flexibility

- Long planning

- Risks of mistakes resulting from missing some principal details at the stage of planning

When to make use of this model

- Unstructured tasks

- Long-term projects with vague requirements

- Tasks with clear requirements

- Short-term projects

- Limited budget

Risk management in fintech outsourcing

Any kind of cooperation with external specialists who aren't your employees may well be related with some risks and difficulties and you must be nicely prepared for them a good way to know how to address them efficiently.

Developers often need to take care of sensitive details. However, in terms of in-house experts, we historically accept as true with them, quite in the event that they have signed anNDA(Non-Disclosure Agreement). With an outsourcing team, the circumstance is usually a little bit more challenging. Without any doubt, you furthermore may should sign an NDA with your vendor. If it is possible, we suggest you use a virtual signature. Among other measures which you could take, we must point out get entry to control (make sure that touchy tips is available only to those specialists who really want to work with it), display the team’s pastime, set very clear regulation, and, needless to say, prefer a authentic outsourcing company with an outstanding popularity.

When you start working with developers, ensure that they really realize the peculiarities of rules which will be applicable on your case. The fintech industry has a row of rules which may range relying on the country. For example, theGDPR(General Data Protection Regulation) is the information safety and privacy law in the EU and theCCPA(California’s Consumer Privacy Act) is the U. S. Law aimed at protective data and privacy rights. It also is imperative to make your apps compliant withKYC(Know Your Customer) andAML(Anti-Money Laundering) regulations.

It is exceptionally major to ascertain all the laws and rules that are in force in those jurisdictions where you are going to launch your solution.

The role of QA in the project’s success is always way more giant than quite a lot of americans suppose. By accomplishing checks of different types all through and after the development method, it is feasible to define and attach bugs and problems that might have an affect on the app’s performance and function in the future. When we are speaking about fintech software, it is of imperative importance to deal with all the vulnerabilities before making the app available to a huge audience. Otherwise, all tech issues can result in serious financial and reputational damages

QA tasks will likely be carried out in-house or outsourced. If you like the second one option, always speak the procedures that QA engineers will use prematurely to make sure that their approaches completely meet your requirements.

Our a success fintech outsourcing projects

We work with projects from different industries and fintech is among them. Thanks to our experience in the software development market, we continuously can discover the proper attitude to every project in accordance with the requirements received from a client.

The first project that we’d like to speak about is Admirals by Admiral Markets, a buying and selling app that offers more than 5,000 trading contraptions. The project presented a completely unique challenge: to effectively handle a large quantity of knowledge processed each and every 2d, all while contemplating the restricted resources available on plenty of phone devices. One of the co-founders of this trading platform found our company on Clutch and decided to contact us to get more information about our services. After some communication and discussion of the details, our team used to be employed to address these challenges. We utilized an wise subscription/un-subscription frame of mind to actual costs, permitting users to constantly be up to date with trading details

Project administration activities have been also done on our facet. It was an example of fantastic cooperation that required a whole lot of attempt from our facet. We did our most effective to deal with all the issues and continuously stay in contact with the customer.

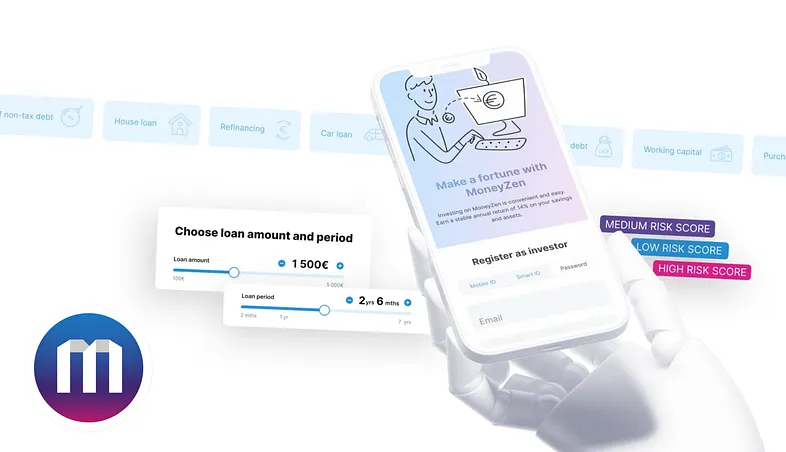

Another case from our exercise is MoneyZen, an Estonian P2P web platform for loans and investments. On this project, we were answerable for front-finish and again-end development, layout, business analysis, and advertising. When this manufacturer came to us, they already had a legacy backend. However, the platform couldn’t boast a big range of users due to its complex processes. Our assignment was to tackle this difficulty and never only to present a present day consumer-pleasant design and enhance the platform with new characteristics but also to find techniques to make it look more lovely to debtors.

After analyzing the case, we offered to integrate the legacy app with Estonian governmental services on the way to automating the registration for borrowers. We also added a row of advanced features that make the interaction with a platform less difficult and faster. Working in this project, we needed to get deeply worried in its specificity, requirements, and pursuits that's usually quite not easy for outsourcing teams. Nevertheless, our specialists coped with this project and helped the purchaser to reach all the set objectives.

Instead of a ultimate phrase

As you'll see fintech development outsourcing can change into a good option for establishments and projects of absolutely differing types. It doesn’t matter whether you deal with a startup or you've got you have got a large industry, increasing your in-house workers with a development team can be a tremendously tough, steeply-priced, and time-consuming procedure. Instead of doing this, you will discover a legit outsourcing partner who will give you the option to perform your tasks with the top level of excellence.

The concept of outsourcing consists of varied models that ensure the desired freedom of preference and flexibility for businesses. You can work with developers from your country or from yet another continent, you'll be able to outsource all the tasks relating to your project realization or just one function. Everything relies on your business model and pursuits.

The major idea is that fintech software outsourcing let you optimize your costs and provide the possibility to work with the best experts without spending it slow on headhunting and recruiting processes.

At Anadea, we are consistently open to new principles and projects. If you have to any support related to fintech software development, you'll always rely upon our team. With our wealthy ability pool and one of a kind experience in the fintech industry, we are certain that we will provide the good effects. As for the forms of cooperation, we do our best to remain as flexible as possible to construct quite effective and comfortable processes for all and sundry. Want to research more about our services and rates? Just contact us!

Originally published athttps://anadea. informationon September 18, 2023.

Join the conversation